All Categories

Featured

Table of Contents

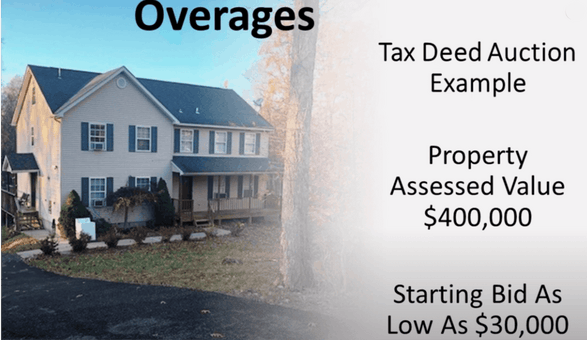

Tax sale overages, the excess funds that result when a home is offered at a tax obligation sale for even more than the owed back taxes, costs, and expenses of sale, represent a tantalizing possibility for the original homeowner or their beneficiaries to recover some worth from their lost possession. The process of declaring these excess can be complicated, bogged down in lawful procedures, and differ dramatically from one jurisdiction to one more.

When a building is offered at a tax obligation sale, the primary objective is to recover the overdue real estate tax. Anything over the owed amount, consisting of fines and the cost of the sale, comes to be an excess. This overage is basically money that should rightfully be returned to the previous homeowner, assuming no other liens or cases on the property take priority.

Recovering tax obligation sale excess can certainly be difficult, laden with legal complexities, governmental hurdles, and possible challenges. With appropriate prep work, recognition, and in some cases professional assistance, it is possible to navigate these waters efficiently. The secret is to approach the procedure with a clear understanding of the demands and a critical plan for addressing the barriers that may arise.

Unpaid Tax Homes

You could have outstanding investigative powers and a team of researchers, but without understanding where to try to find the cash, and exactly how to get it out legally, it's just interesting details. Now think of for a moment that you had an examined, verified 'prize map' that revealed you exactly how to find the cash and how to get it out of the court and right into your account, without bothering with finder legislations.

Previously that is . Yes! . what as soon as was impossible is currently conveniently attained . And what we share with you will have a bigger influence on your monetary future than anything else you have ever seen online. Insurance claim massive blocks of cash, some $100K+!, with zero competition? Were the only ones that likewise pursue mortgage and HOA repossession excess! Companion with a company that will train you and do all the heavy lifting for you? Operate a company that will permit You to call the shots and has no restriction on income? Have access to YEARS of data, where you could literally pick & choose what to take? Aid other individuals while you are creating individual wealth? Make indisputable - this is not a 'get abundant fast' program.

Miss mapping is the process of finding current call info, such as addresses and telephone number, to situate and get in touch with someone. In the past, miss mapping was done by debt collection agency and private investigators to locate people who where avoiding a financial debt, under examination, or in difficulty with the legislation.

To get clear title after a tax action has really been gotten, please call a lawyer to start that procedure. The buyer of a mobile home will certainly be required to authorize a limited power of lawyer to allow the Region to title the mobile home in your name at the SCDMV along with register the mobile home with the Region.

The regulations calls for that an insurance claim be sent. By regulation, we can not accept situations after one year from the taped day, neither can we start processing of instances up till one year has passed from the precise very same day. The Taxation firm will certainly send a reference to the Board of Supervisors referring to the disposition of the excess profits.

The homes sold at the DLT sale are marketed to collect delinquent tax responsibilities owed to Jackson County, MO. If the property costs higher than what is owed in tax obligation obligations and fees to the Area after that existing document proprietors(s) or other interested occasions, such as, a lien proprietor could request those funds.

Unpaid Taxes On Homes For Sale

Please note: This details is for instructional functions just and is illegal suggestions or an alternative to collaborating with lawful encourage to represent you. No attorney-client connection or advantage has really been created as a result of this discussion and no discretion affixes to anything stated here on a public internet site.

The California Revenues and Tax Obligations Code, Section 4675, states, in component (paraphrased): Events of Interest rate and their order of priority are: First, lien owners of file prior to the recordation of the tax act to the buyer in the order of their leading priority (Unclaimed Tax obligation Sale Overages). Any kind of sort of private with title of file to all or any kind of section of the house before the recordation of the tax deed to the buyer.

Tax Obligation Sale Overages Tax Auction Overages Before the choice by the Court, Michigan was amongst a minority of states who allowed the retention of excess profits from tax-foreclosure sales. government real estate tax sales. Residential or commercial residential or commercial property owners that have actually shed their home as an outcome of a tax obligation repossession sale currently have a case against the location for the difference in between the amount of tax commitments owed and the quantity comprehended at the tax commitment sale by the Area

In the past, miss tracing was done by debt enthusiast and private investigators to find people that where preventing a debt, under examination, or in problem with the regulations.

Below is a checklist of the most usual customer concerns. If you can't discover a response to your question, please do not be reluctant to reach out to us. That is needed to submit tax overages hands-on pdf? All individuals that are needed to file a federal earnings tax return are also needed to submit a tax obligation overages manual.

How To Find Homes With Tax Liens

Depending on their filing standing and revenue degree, some people may be called for to submit a state earnings tax return. Just how to fill out tax obligation excess hand-operated pdf?

Complying with the directions on the form, fill out all the fields that relate to your tax situation. Make certain to supply exact info and check it for accuracy. 3. When you involve the area on declaring for tax overages, ensure to offer all the details called for.

4. As soon as you have actually finished the kind, make certain to check it for precision prior to sending it. 5. Submit the form to the pertinent tax obligation authority. You will typically require to mail it in or submit it online. What is tax obligation excess manual pdf? A tax obligation overages hand-operated PDF is a file or overview that provides info and directions on how to discover, gather, and insurance claim tax excess.

Tax Seizure Auction

The excess quantity is usually refunded to the owner, and the handbook gives support on the process and procedures associated with asserting these reimbursements. What is the function of tax obligation excess hands-on pdf? The purpose of a tax obligation overages manual PDF is to offer details and support associated to tax excess.

Tax obligation Year: The certain year for which the overage is being reported. Amount of Overpayment: The complete amount of overpayment or excess tax paid by the taxpayer. Source of Overpayment: The reason or resource of the overpayment, such as excess tax obligation withholding, approximated tax obligation payments, or any various other applicable resource.

Refund Request: If the taxpayer is requesting a reimbursement of the overpayment, they need to indicate the total up to be reimbursed and the preferred approach of reimbursement (e.g., straight down payment, paper check). 6. Supporting Documents: Any kind of appropriate supporting papers, such as W-2 kinds, 1099 kinds, or various other tax-related invoices, that confirm the overpayment and justify the refund request.

Trademark and Day: The taxpayer must authorize and date the paper to accredit the accuracy of the info supplied. It is essential to keep in mind that this details is generic and may not cover all the details demands or variations in different regions. Always seek advice from the relevant tax obligation authorities or speak with a tax expert for exact and up-to-date information regarding tax overages reporting.

Table of Contents

Latest Posts

Excess Funds From Tax Sale

Tax Lien Investing

Tax Lien Investing Florida

More

Latest Posts

Excess Funds From Tax Sale

Tax Lien Investing

Tax Lien Investing Florida